What is RPGT? (II)

- Sarah

- Jul 26, 2023

- 3 min read

When it comes to investments to build wealth in Malaysia, no other method is as popular as property investing, be it residential or commercial land/buildings or lots.

However, properties are also an integral part of people’s lives, as places of living & places of work.

Therefore, although property investment is allowed, the government is also required to keep the property speculators in check to let people have the chance to own their own property (usually their 1st house). Hence, the introduction of Real Property Gains Tax (RPGT), or Cukai Keuntungan Harta Tanah (CKHT) in Malay, a capital tax governed by LHDN to curb property speculation.

In this series of blogs, we will introduce to you the basic aspects of RPGT. This blog covers the RPGT exemptions & the different tax rates used to determine RPGT liability.

Exemptions

As of writing, all RPGT exemptions are only relevant to individuals, so companies who make disposal will have to pay RPGT in full. 3 exemptions are available as follows:

10% or RM10k exemption This exemption is only available to individual disposers. The exemption is a 10% or RM10k (whichever is greater) reduction of chargeable gains. In case of a part disposal, where some portion of the original asset is still held by the disposer to which an acquisition price is related, the exemption will be apportioned accordingly.

Lifetime private residence exemption

This exemption is only available if the disposer is a Malaysian citizen or Malaysian permanent resident. An individual can elect for RPGT exemption on any of their disposal of their private resident in writing. This exemption is granted once in an individual’s lifetime and is irrevocable once applied.

Gift exemption This exemption is only available if the disposer is a Malaysian citizen. If the asset was given as a gift out of love & affection, it would normally be deemed as disposed at market value. However, gifts between husband-wife, parent-child, and grandparent-grandchild under this exemption will be deemed transferred at no-gain-no-loss (hence no liability to RPGT).

Tax Rates

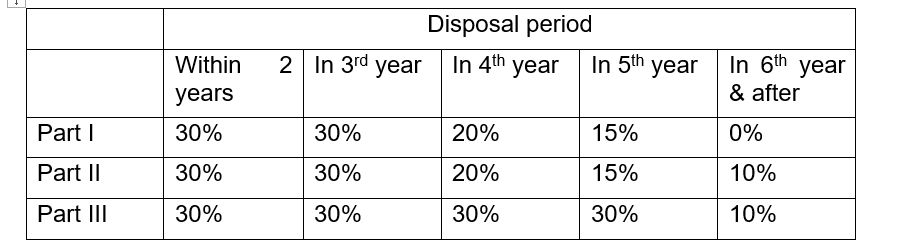

After applying for any relevant exemptions, disposers will then apply the appropriate RPGT tax rate based on the type of disposer they are and the time between the acquisition & disposal date of the asset. The types of disposers are categorised as the following:

1)Individuals who are Malaysian citizens or permanent residents & other categories not part of the other categories (Part I Schedule 5 RPGT Act)

2)Companies incorporated in Malaysia & trusts (Part II Schedule 5 RPGT Act)

3)Individuals who are not Malaysian citizens nor permanent residents & companies not incorporated in Malaysia (Part III Schedule 5 RPGT Act)

The following is a summary of the tax rates which are in effect as of July 2023:

Do note the tax rates before 1 January 2022 are different. Refer to LHDN’s official schedule to know more about past RPGT rates.

Conclusion

RPGT is a massive consideration when purchasing property, either for use or merely as an investment. The consequences of not submitting RPGT returns or submitting incorrect returns can be severe, as the penalties charged are scaled to the transaction amount. When dealing with properties, which often value in the ten/hundred thousand or even millions, the penalties will quickly rack up. Therefore, it is imperative that you are well aware of the RPGT process.

With that, ends this blog! Be sure to check out the previous blog on arriving at chargeable gains to grasp a basic understanding of RPGT.

Disclaimer

All content provided on this blog is for informational purposes only. The owner of this blog makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site.

The owner will not be liable for any errors or omissions in this information nor for the availability of this information. The owner will not be liable for any losses, injuries, or damages from the display or use of this information.

References

RPGT Guidelines 2023 (Translated by EY): https://www.ey.com/en_my/tax-alerts/updated-real-property-gains-tax-rpgt-guidelines

Comments